Decoding the Insurance Jargon: A Laid-Back Guide to Policies

Decoding the Insurance Jargon: A Laid-Back Guide to Policies

Let’s face it, insurance policies aren’t exactly beach reading. They’re packed with terms that sound like they were invented by lawyers (well, some probably were!). But understanding the basics of your insurance policy doesn’t have to be a headache. Think of this as a friendly chat, breaking down what you need to know to protect yourself and your stuff.

The Basic Blueprint: What’s in an Insurance Policy?

At its heart, an insurance policy is a contract. You (the insured) pay a premium to an insurance company (the insurer), and in exchange, they promise to cover certain financial losses if something bad happens (that’s the "insured event"). It’s like a safety net, catching you when things go wrong.

Every policy has some key ingredients:

-

Declarations Page: This is the "who, what, where" of your policy. It spells out your name, address, what you’re insuring (your car, your house, your health, etc.), the policy period (how long the coverage lasts), and the coverage limits (the maximum amount the insurer will pay). Consider this as the table of contents.

-

Coverage Agreement: This is where the insurer gets specific about what they will cover. It outlines the types of losses or events that are protected under the policy. For example, a car insurance policy’s coverage agreement might list things like collision damage, liability for injuries you cause to others, and protection against uninsured drivers.

-

Exclusions: This is a super important section. Exclusions list the things the policy won’t cover. It’s like the fine print, but you absolutely need to read it. Common exclusions in a homeowner’s policy might include damage from earthquakes or floods (you’d typically need separate policies for those).

-

Conditions: These are the rules of the game. Conditions spell out your responsibilities and the insurer’s responsibilities. For example, you’ll likely have a condition requiring you to report a loss promptly and to cooperate with the insurer’s investigation.

-

Definitions: Insurance policies use a lot of specialized language. The definitions section clarifies exactly what certain terms mean within the context of the policy. This can be crucial because a word’s everyday meaning might be different from its legal definition in the policy.

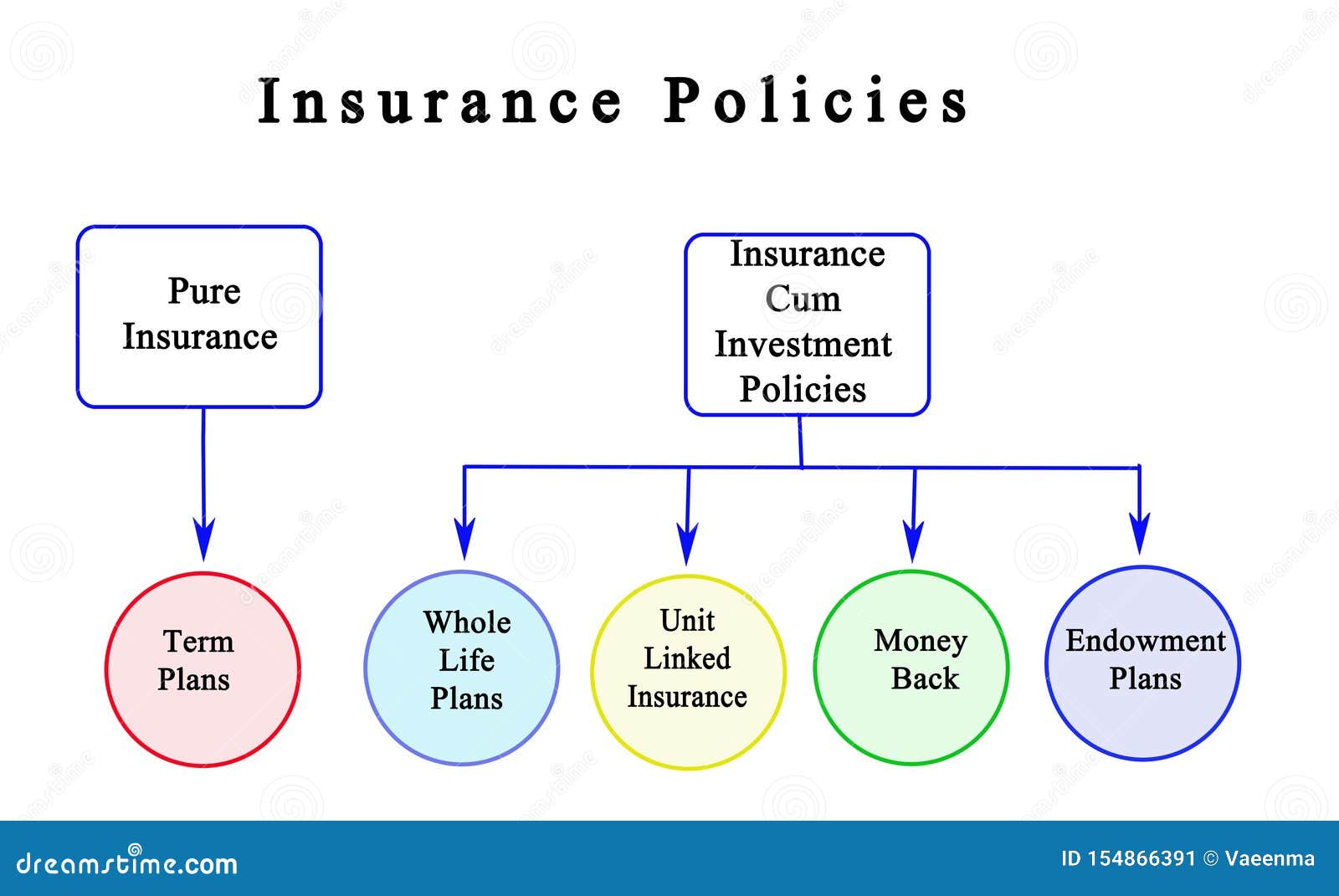

Types of Insurance: A Quick Tour

The world of insurance is vast, but here’s a rundown of some common types you’ll likely encounter:

-

Health Insurance: Helps cover medical expenses, from doctor visits to hospital stays to prescription drugs.

-

Auto Insurance: Protects you financially if you’re in a car accident. It can cover damage to your car, injuries to yourself or others, and liability if you’re at fault.

-

Homeowners Insurance: Safeguards your home and belongings against damage from things like fire, wind, theft, and vandalism. It also provides liability coverage if someone is injured on your property.

-

Renters Insurance: Similar to homeowners insurance, but it covers your belongings and liability if you’re renting a house or apartment.

-

Life Insurance: Provides a payout to your beneficiaries (usually family members) if you die. It can help cover funeral expenses, pay off debts, and provide financial security for your loved ones.

-

Disability Insurance: Replaces a portion of your income if you become disabled and can’t work.

-

Travel Insurance: Covers unexpected expenses while you’re traveling, such as trip cancellations, medical emergencies, and lost luggage.

Decoding the Lingo: Key Terms to Know

Insurance policies are full of jargon, but here are some of the most important terms to wrap your head around:

-

Premium: This is the amount you pay regularly (monthly, quarterly, annually) to keep your insurance policy active. Think of it as your subscription fee for peace of mind.

-

Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible on your car insurance policy and you get into an accident that causes $2,000 in damage, you’ll pay the first $500, and your insurer will cover the remaining $1,500. Generally, higher deductibles mean lower premiums.

-

Coverage Limit: This is the maximum amount your insurance policy will pay for a covered loss. It’s crucial to choose coverage limits that are high enough to adequately protect you.

-

Liability: This refers to your legal responsibility for causing harm to someone else. Liability coverage in an insurance policy protects you financially if you’re sued for causing injury or damage.

-

Exclusion: As mentioned earlier, this is a specific event or situation that your insurance policy doesn’t cover.

-

Endorsement (or Rider): This is an amendment or addition to your insurance policy that changes the coverage in some way. For example, you might add an endorsement to your homeowner’s policy to cover valuable jewelry.

-

Actual Cash Value (ACV): This is the current value of an item, taking into account depreciation (the loss of value over time). If your policy pays out based on ACV, you’ll receive the replacement cost of the item minus depreciation.

-

Replacement Cost: This is the cost to replace an item with a new one of similar type and quality, without deducting for depreciation. Replacement cost coverage is generally more expensive than ACV coverage, but it provides better protection.

-

Claim: This is a formal request to your insurance company to pay for a covered loss.

-

Policy Period: The length of time your insurance policy is in effect.

Shopping for Insurance: Tips for Getting the Best Deal

-

Shop Around: Don’t just settle for the first quote you get. Get quotes from multiple insurance companies to compare prices and coverage options.

-

Understand Your Needs: Before you start shopping, take some time to assess your needs. How much coverage do you really need? What are your biggest risks?

-

Consider Bundling: Many insurance companies offer discounts if you bundle multiple policies together (e.g., auto and home).

-

Read the Fine Print: It’s tempting to skip over the details, but it’s crucial to read the entire policy carefully before you buy it. Pay attention to the exclusions, conditions, and coverage limits.

-

Ask Questions: If you don’t understand something, don’t be afraid to ask questions. Your insurance agent should be able to explain the policy in plain English.

-

Review Your Policy Regularly: Your insurance needs may change over time, so it’s a good idea to review your policy periodically to make sure it still provides adequate coverage.

The Claims Process: What to Expect

Okay, so something bad happened, and you need to file a claim. Here’s a general idea of what to expect:

-

Report the Loss: Contact your insurance company as soon as possible to report the loss.

-

Document the Damage: Take photos or videos of the damage. If possible, prevent further damage (e.g., cover a hole in your roof with a tarp).

-

Complete a Claim Form: Your insurance company will provide you with a claim form to fill out. Be as accurate and detailed as possible.

-

Cooperate with the Adjuster: The insurance company will assign an adjuster to investigate your claim. Cooperate with the adjuster and provide any information they request.

-

Review the Settlement Offer: Once the adjuster has completed their investigation, they’ll make a settlement offer. Review the offer carefully and make sure it adequately covers your losses.

-

Negotiate (If Necessary): If you’re not happy with the settlement offer, you can negotiate with the insurance company. Be prepared to provide evidence to support your claim.

A Final Word of Advice

Insurance can seem complicated, but it doesn’t have to be intimidating. Take your time, do your research, and don’t be afraid to ask questions. Understanding your insurance policy is an important step in protecting yourself and your financial future.