Navigating the World of Insurance: Why Comparing Quotes is Your Secret Weapon

Navigating the World of Insurance: Why Comparing Quotes is Your Secret Weapon

Okay, let’s talk insurance. It’s not exactly the most thrilling topic, is it? But trust me, understanding how to shop for it can save you a ton of money and headaches down the road. One of the smartest moves you can make is to compare insurance quotes. Think of it as your secret weapon in the battle against overpaying for something you absolutely need.

Why Bother Comparing? The Million-Dollar Question (Literally, Maybe)

Seriously, why spend the time clicking around and filling out forms? Well, here’s the thing: insurance companies aren’t all created equal. They use different formulas to calculate your risk, and those formulas can be wildly different. What one company sees as a minor blip in your driving record, another might treat like you’re a professional race car driver (gone rogue).

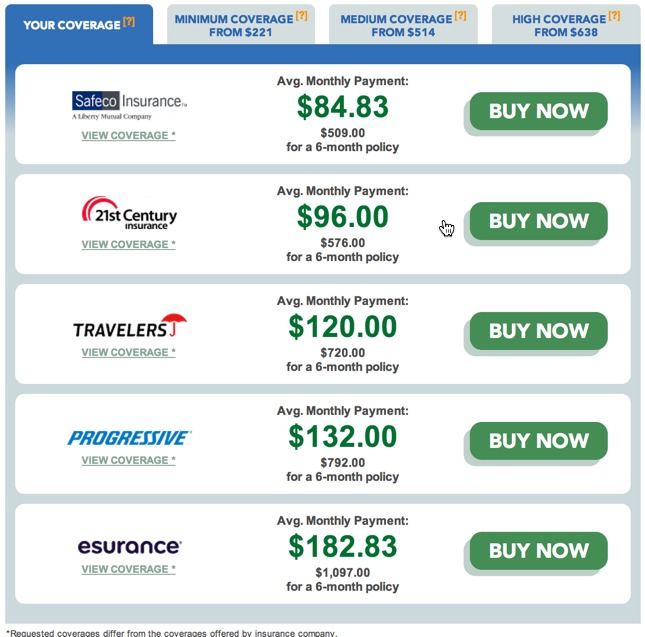

- Price Differences: This is the big one. You might find that one company offers you a rate that’s hundreds, or even thousands, of dollars lower than another for the exact same coverage. It’s like finding the same shirt at two different stores, one charging full price and the other having a massive sale. Which one would you pick?

- Coverage Variations: While policies might seem similar on the surface, the details matter. One policy might have better coverage for certain situations, like roadside assistance or rental car reimbursement, while another might skimp on those extras.

- Discounts Galore: Insurance companies love to dangle discounts in front of you. But the types of discounts, and how much they save you, can vary widely. Comparing quotes lets you see which company offers the discounts that actually apply to your situation, whether it’s a good student discount, a multi-policy discount, or a discount for having safety features in your car.

- Customer Service Matters: Price isn’t everything. You want to make sure you’re dealing with a company that’s responsive, helpful, and easy to work with. Comparing quotes often involves reading reviews and checking customer satisfaction ratings, which can give you a sense of what it’s like to be a customer of that company.

- Peace of Mind: Knowing you’ve done your research and found the best possible deal gives you peace of mind. You can rest easy knowing you’re not overpaying and that you have the right coverage for your needs.

What Kind of Insurance Are We Talking About? (Spoiler: All of Them!)

The beauty of comparing quotes is that it applies to almost any type of insurance you can think of. Here are some of the most common:

- Auto Insurance: This is probably the one most people think of first. Comparing auto insurance quotes is crucial, especially if you’ve recently moved, had a change in your driving record, or just want to make sure you’re still getting the best rate.

- Homeowners Insurance: Protecting your biggest investment is a no-brainer. Homeowners insurance rates can vary based on factors like your location, the age of your home, and the coverage you need.

- Renters Insurance: Even if you don’t own your home, renters insurance is essential for protecting your belongings. It’s also surprisingly affordable, and comparing quotes can help you find the cheapest option.

- Life Insurance: This one’s about protecting your loved ones in case something happens to you. Life insurance rates depend on factors like your age, health, and the amount of coverage you need.

- Health Insurance: Navigating the world of health insurance can be a real headache, but comparing quotes is a good place to start. You can compare plans based on premiums, deductibles, and coverage.

- Business Insurance: If you own a business, you need to protect it from potential risks. Business insurance comes in many forms, including liability insurance, property insurance, and workers’ compensation insurance.

- Pet Insurance: Our furry friends deserve protection too! Pet insurance can help you cover the cost of vet bills, which can be surprisingly high.

Where Do You Find These Magical Quotes?

Alright, so you’re convinced that comparing quotes is a good idea. But where do you actually find them? Here are a few options:

- Online Comparison Websites: These websites are like one-stop shops for insurance quotes. You enter your information once, and they provide you with quotes from multiple companies. Some popular options include websites like NerdWallet, The Zebra, and ValuePenguin.

- Pros: Convenient, easy to use, and can save you a lot of time.

- Cons: Not all companies are included, and the quotes might not be 100% accurate until you provide more detailed information.

- Directly from Insurance Companies: You can also go directly to the websites of individual insurance companies and get quotes. This might take more time, but it ensures you’re getting quotes from all the companies you’re interested in.

- Pros: You get quotes directly from the source, and you can often find discounts that aren’t available through comparison websites.

- Cons: It can be time-consuming to visit multiple websites and fill out multiple forms.

- Independent Insurance Agents: These agents work with multiple insurance companies and can provide you with quotes from a variety of sources. They can also help you understand the different types of coverage and choose the right policy for your needs.

- Pros: Personalized service, expert advice, and access to multiple companies.

- Cons: They might not represent all companies, and they might have a bias towards certain insurers.

What Info Do You Need to Get a Quote? (Be Prepared!)

Before you start hunting for quotes, gather all the information you’ll need. This will make the process faster and ensure you get accurate quotes. Here’s a general idea of what you’ll need:

- Personal Information: Your name, address, date of birth, and Social Security number (for some types of insurance).

- Driving Record (for auto insurance): Information about any accidents, tickets, or other violations.

- Vehicle Information (for auto insurance): The make, model, and year of your car, as well as the vehicle identification number (VIN).

- Property Information (for homeowners or renters insurance): The address of your home or apartment, the age of the building, and the value of your belongings.

- Health Information (for health or life insurance): Your medical history, current health status, and lifestyle habits.

- Coverage Preferences: How much coverage do you want? What are your priorities in a policy?

Decoding the Quotes: What to Look For

Okay, you’ve got a stack of quotes in front of you. Now what? Don’t just look at the bottom line. Here’s what to pay attention to:

- Premiums: This is the amount you’ll pay each month (or year) for your insurance.

- Deductibles: This is the amount you’ll pay out of pocket before your insurance kicks in. A higher deductible usually means a lower premium, but you’ll have to pay more if you file a claim.

- Coverage Limits: This is the maximum amount your insurance will pay for a covered loss. Make sure the coverage limits are high enough to protect your assets.

- Exclusions: These are the things that your insurance doesn’t cover. Read the fine print carefully to understand what’s excluded from your policy.

- Discounts: See what discounts are applied to your quote and make sure you actually qualify for them.

- Customer Reviews: Check online reviews to see what other customers have to say about the company’s customer service, claims process, and overall experience.

- Financial Stability: Make sure the insurance company is financially stable and able to pay out claims. You can check their financial ratings with agencies like A.M. Best or Standard & Poor’s.

Don’t Be Afraid to Negotiate (Seriously!)

Here’s a little secret: insurance rates aren’t always set in stone. You might be able to negotiate a lower rate, especially if you have a good driving record, a clean claims history, or are willing to bundle multiple policies with the same company. Don’t be afraid to ask! The worst they can say is no.

When Should You Compare Quotes? (The Million-Dollar Question, Part 2)

The best time to compare quotes is:

- Before You Buy a New Policy: This is the most obvious time to compare quotes.

- When Your Policy is Up for Renewal: Don’t just automatically renew your existing policy. Take the time to compare quotes and see if you can find a better deal elsewhere.

- After a Major Life Change: Events like moving, getting married, buying a new car, or having a baby can all affect your insurance rates.

- If Your Credit Score Changes: Your credit score can impact your insurance rates, so it’s a good idea to compare quotes if your credit score improves.

- Just Because!: Even if nothing has changed, it’s a good idea to compare quotes every year or two just to make sure you’re still getting the best deal.

The Bottom Line: Comparison is Key

Comparing insurance quotes isn’t the most exciting task in the world, but it’s one of the smartest things you can do to save money and protect yourself. By taking the time to shop around and compare your options, you can find the best coverage at the best price. So go forth, compare, and conquer the world of insurance!

Important Note: The information provided in this article is intended for general informational purposes only and does not constitute professional financial or insurance advice. It is essential to consult with a qualified insurance professional or financial advisor for personalized guidance based on your specific circumstances.